As trade under African Continental Free Trade Area (AfCFTA) gains momentum with States banking on the development to end decades-long markets fragmentation, all eyes are swiftly shifting to unmet plans of creation of a single African currency.

The absence of a common currency for trade either regionally or at continental level has seen those trading or considering to do so spend considerable amount of time and a chunk of their capital to purchase currency that can be accepted by peers when transacting.

There are 42 currencies in use across Africa with dissimilar strengths depending on the size of economies and local macro-economic policy stability or instability.

Therefore, concerns linked to convertibility problems are what have seen traders increasingly resort to third currencies such as the United States dollar, in most cases, to settle routine cross border business transactions.

Also read: Why Africa must prioritise merging currencies for free trade

For instance, Kotiheza, a cooperative comprising of 36 women engaged in cross-border trade of agricultural commodities between Rwanda, DR Congo, Uganda and Tanzania incurs regular costs buying US dollars every time members are buying in bulk from these countries.

The cooperative is headquartered in Rubavu, Rwanda’s border town with the neighboring DR Congo, and constantly bears the cost of foreign exchange fluctuations on their imports in the four countries.

The cost of this to their business has kept on the rise over time as the dollar increasingly gains against both the franc and the shilling, currencies of these East African countries.

“It is a big inconvenience to businesses, and we are not sure how trade under AfCFTA is going to change that in absence of common regional currency or a single one at continental level,” explained Moussa Babonampoze, the cooperative head.

On its part, Entreprise Urwibutso, Rwanda-based agro-processing firm behind the popular Akabanga chili oil brand on continental and global markets, it is the consumers who bear the brunt of recurrent currency convertibility problems in trade.

“Prices of our products keep fluctuating as result, and that hurt the end users with effects on the economy,” the firm’s Executive Director Alexis Nkundayezu told NewsPaper Africa, adding that business people always factor these currency-related costs in the final prices of goods they bring to the markets.

Prices of our products keep fluctuating as result, and that hurt the end users with effects on the economy

Alexis Nkundayezu, Executive Director, Entreprise Urwibutso

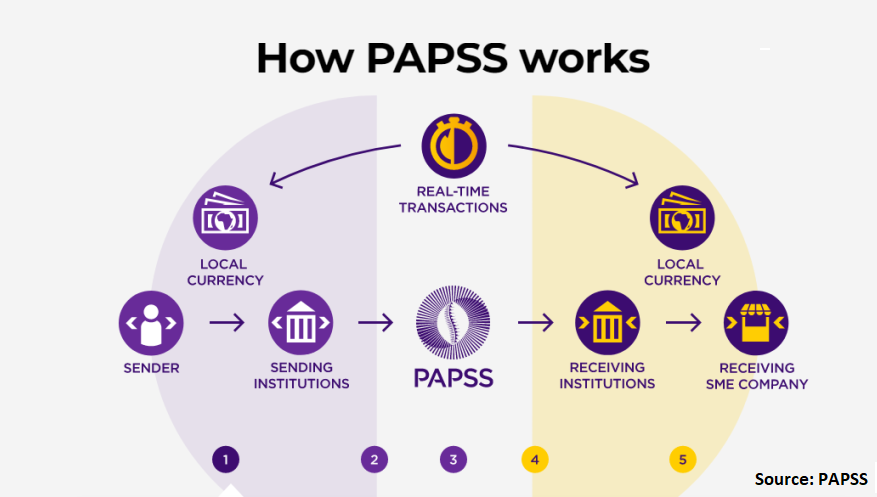

Mr. Nkundayezu pins his hopes on the success of the Pan-African Payment and Settlement System (PAPSS), the initiative spearheaded by Africa Export Import Bank (Afreximbank) to enable traders to settle business transactions without having to resort to third currencies like the Dollar, Euro or Pound.

Business people, including Mr. Nkundayezu, learnt about the initiative through campaigns that are carried out to boost awareness about trading under AfCFTA, and are eager to see more countries sign up to the payment system.

Before its launch on January 2022, PAPSS was piloted in six countries of the West African Monetary Zone namely Nigeria, Ghana, Sierra Leone, Liberia and Gambia.

Albert Muchanga, African Union (AU) commissioner for trade and industry told NewsPaper Africa that the roll out has since expanded beyond West Africa to East and Southern Africa with Djibouti, Zambia and Zimbabwe having come on board already.

“As the year goes on we expect more AU member States to be part of the system. In West Africa where the project was piloted all central banks are fully involved and are able to mobilise private commercial banks. In countries like Nigeria and Ghana, they are able to a do as many as a hundred transactions on daily basis,” he said.

In the case of Entreprise Urwibutso and Kotiheza, PAPSS promises to make routine business transactions hassle free as cross-border clients can make payments for delivered goods or products in their local currencies for the seller to receive the equivalent in Rwandan francs in the bank account.

In West Africa where the project was piloted, all central banks are fully involved and are able to mobilise private commercial banks. In countries like Nigeria and Ghana, they are able to a do as many as a hundred transactions on daily basis

Albert Muchanga, AU Commissioner for Trade and Industry

The same would apply when it comes to purchasing goods and raw materials from suppliers in markets beyond Rwandan borders. The system makes it possible to pay cross border suppliers in local currency while they receive the funds in their own national currencies.

It will require buy-in from respective countries’ banking sector regulators and financial institutions before this can become reality across the board.

Also read: Pan-African payment system rollout reaches three more countries

The projection is to have all central banks and commercial banks across the continent signed up to PAPSS by end of 2024 and 2025 respectively.

Unmet goal

Business people, however, say that in light of existing African currencies’ power parity, leaders could consider merging them into one as a solution in the long term. This view is shared by economic analysts who are quick to point to unmet plans to establish a single African currency.

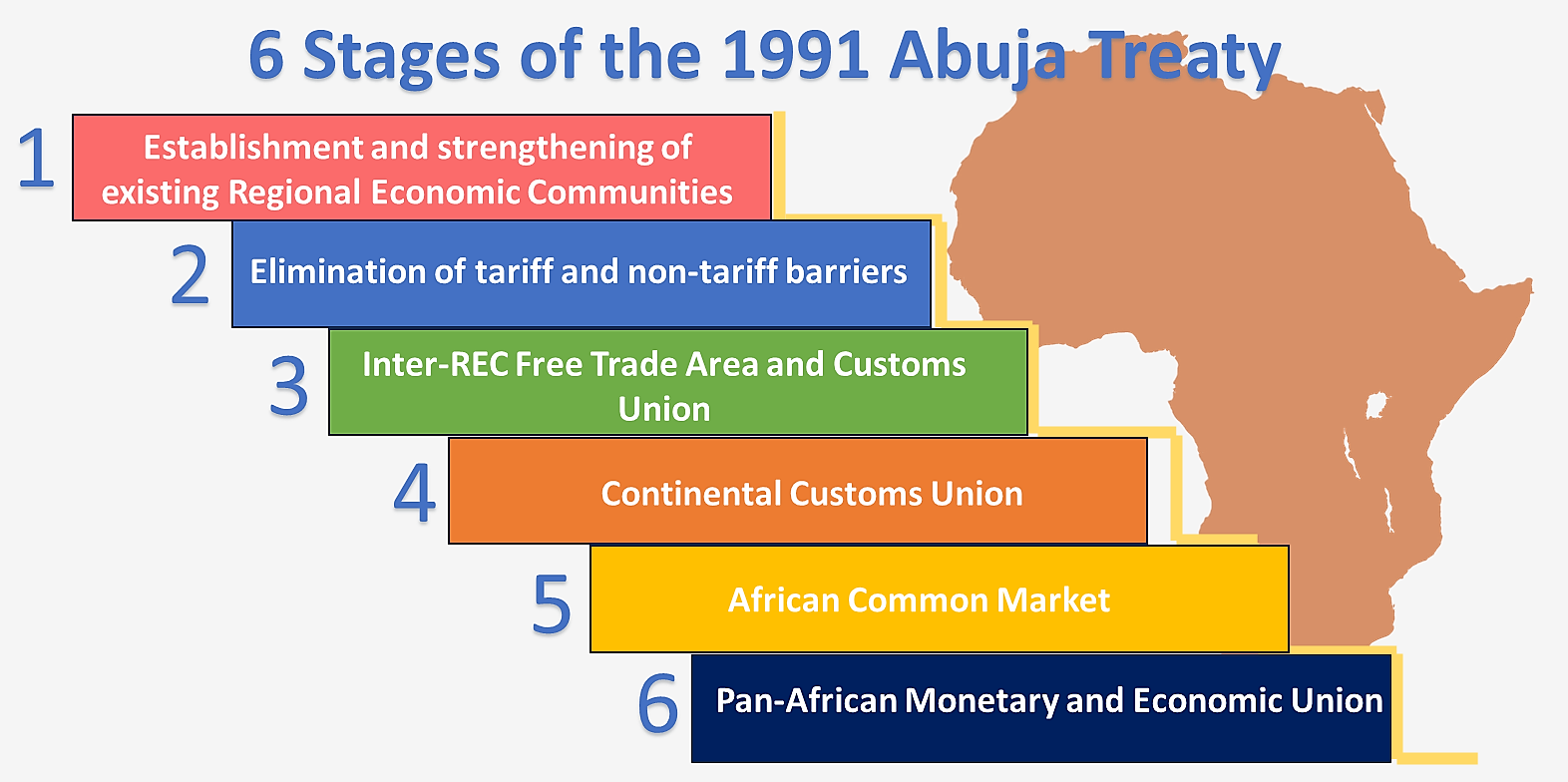

Negotiations to have the latter had been in the works since the 1991 Abuja Treaty under which African leaders promised to deliver a monetary union with all the 42 national currencies merged into a single one, and an African central bank by 2021.

Also read: Amid rising import bill, Africa sees AfCFTA as last opportunity to end colonial trade practices

Currency convertibility problems faced by cross border traders and those moving to leverage trade under AfCFTA have also revived memories of unmet common regional currencies plans by Regional Economic Communities (RECs) such as the East African Community (EAC), Common Market for Eastern and Southern Africa (COMESA), Economic Community of West African States (ECOWAS) and others.

The AU indicated that work is underway to stablish the African Monetary Institute, after which the continent will be in a position to establish the African central bank and later a single African currency.

Mr. Muchanga who shared the details did not state the timelines. He indicated, however, that these financial institutions are much needed to position the continent to be competitive in the global arena.

The bigger plan, he said, include fast-tracking the establishment of four African financial institutions, alongside striving to achieve a good level of macro-economic convergence, something finance ministers and the association of African central banks have been working on together with the AU and partner institutions.

In the offing

“We should be able to roll out an African stock market in addition to other financial institutions that are in the offing. One is the African Investment Bank, the other one is the African Monetary Fund, and the other one which was recommended to the heads of States and Governments and accepted is the African Financial Stability Mechanism,” Muchanga revealed at AfreximBank’s 30th Annual Meeting this year.

The AU also signed a memorandum of understanding with African Securities Exchange Commission last year to create a Pan-African Stock Exchange.

Also read: AfCFTA brings boon to youth and women, but call for changes to unlock full potential

Meanwhile, Afreximbank has so far onboarded to PAPSS five African multinational commercial banking groups namely Access Bank Group, Ecobank Group, KCB Group, Standard Bank Group and UBA Group.

Africa is estimated to incur $5 billion annually to settlement charges and fees in routine business transactions internally under the traditional payment systems which involve using third currencies, mostly through intermediary banks that are based outside its borders.

~ Data visualization by Jesse Mwatsama

———

This publication is made possible by the AU Media Fellowship program, which is implemented by the African Union (AU) through the Information and Communication Directorate, supported by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ). Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of GIZ or the African Union.