Morocco recently emerged as one of the major exporters of fertilizer around the time many African countries battled a shortage as a result of the Russia-Ukraine conflict.

However, what puzzles many is how the fertilizer supplies from the Northwest African country did nothing to salvage the situation of its peers on the continent.

Instead, volumes of fertilizers the country produces were being shipped to Europe and Brazil.

“If there was a supply network for fertilizer within Africa, the spillovers of supply disruptions from the Russia-Ukraine conflict would have been avoided. EU calls this strategic autumn.

We would also have avoided the rise in prices that has gone up by as much as 11 per cent for grain, and 60 per cent for fertilizer,” Albert Muchanga, Commissioner for Economic Development, Trade, Tourism, Industry and Minerals at African Union (AU) told delegates at a side event of the on-going summit on industrialisation in Niger on Tuesday.

Also read: Costs, connectivity and illiteracy hold back Africa digital economy potential – REPORT

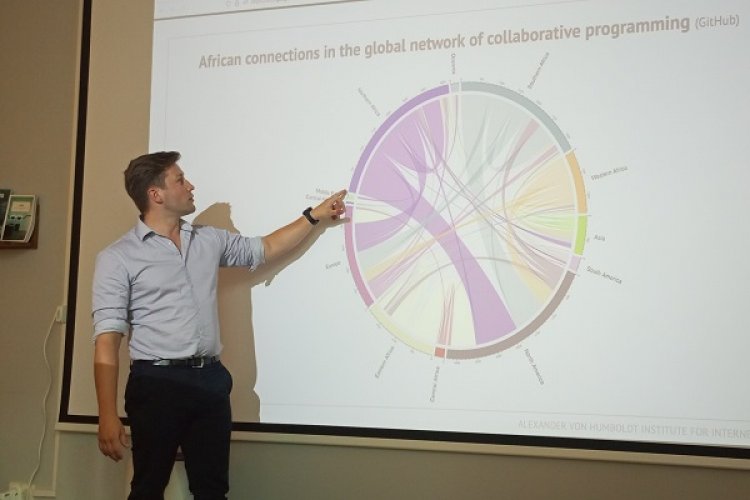

Experts say countries on the continent could unlock $22 billion export growth potential and effectively eradicate recurrent problems linked with global supply chain disruptions, high transport costs and price fluctuations if they leveraged trade intelligence to do more business with one another.

The assertion is backed by data from the African Trade Observatory (ATO), a web portal set up to facilitate traders, industrialists, investors and policy makers on the continent to access real time information on trade flows across countries, products and markets.

ATO is part of the project jointly implemented by the AU and partners to enable trade sub-sector players to access crucial information such as market conditions, tariffs at borders and regulatory requirements, among others.

From ATO data, it has emerged that lack of market information see most African countries incur losses from taking raw materials and semi-processed products to markets afar such as Europe and Asia even as peers on the continent import the same from overseas.

For instance, the Democratic Republic of Congo, Congo and Zambia have been exporting volumes of products such as copper alloys to Asia and Europe at a time Morocco, South Africa, Tunisia and Algeria import the same copper materials and byproducts largely from the West.

The trend persisted despite the existence of bilateral, regional and continental preferential trade treaties signed by African countries in the name of boosting trade with one another.

“A number of agreements have been signed but the level of utilisation is extremely low with potentials that are not exploited at all. And there is no point of adding more agreements when existing ones are not optimized,” observed Mondher Mimouni, Chief of Trade and Market Intelligence at International Trade Centre (ITC).

Setback

The trend has been cited as a stumbling block in the continental drive to industrialise and exploit the potential offered by the growing demand for assorted goods and products.

A number of agreements have been signed but the level of utilisation is extremely low with potentials that are not exploited at all. And there is no point of adding more agreements when existing ones are not optimized.

Mondher Mimouni, Chief of Trade and Market Intelligence, International Trade Centre (ITC)

It makes it even hard for economic players across the continent to maximise the benefits of the 1.4 billon people continental free trade market.

Also read: Made in Africa: States work to harmonise standards, rules of origin requirements

Officials figures estimate intra-African trade at between 15 per cent to 18 per cent annually, the lowest of any region of the world.

Chipoka Mulenga, minister of Commerce, Trade and Industry for Zambia, the country that embraced ATO to facilitate regional trade and policy formulation said there is need for the platform to equally provide analyses on trade deficits and surpluses, obstacles to trade, and investment opportunities in countries.

The data are crucial for traders, investors and other eceonomic players to narrow down to markets, products, sectors or countries that offer better returns.

“The [second] phase should also explore the possibility to include industry issues such as Sanitary and Phytosanitary (SPS) requirements, Standards and regulations, other non-tariff barriers, as well relevant market information such as prices and exchange rates,” he said.

~ Reporting by Johnson Kanamugire in Niamey