With mobile money adoption and use on a steady rise across parts of Africa, one hoped that millions of credit invisibles and the unbanked – those with no bank account or credit history — could swiftly have their way into financial inclusion.

It’s taking long.

Experts are of the view that lenders are partly to blame, because they largely still base their credit assessment on traditional scoring models which consider things like employment and collateral in gauging creditworthiness.

A few have moved to consider additional sources of data like mobile airtime, data payments or other aspects of the growing financial activity routinely carried out by people powered through use of mobile across Africa.

“Many people pay rent on time and in full each month, they buy airtime and data on a consistent, frequent basis and could be great candidates for traditional credit. They just don’t have a traditional credit history to be used as a benchmark,” opines Ferdie Pieterse who advocates for a more inclusive credit economy for individual consumers as well as small and medium enterprises.

“We believe that lenders need to go beyond traditional scoring criteria and consider a multitude of non-traditional variables to support their risk assessment processes.”

Mr. Pieterse is Chief Executive Officer at Experian, one of the largest credit bureaus operating in South Africa. He spoke to this Publication on the sidelines of Mobile World Congress in Kigali in October.

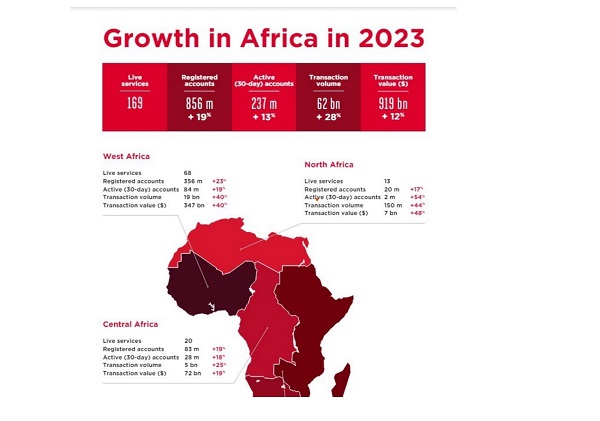

Billion-dollar industry

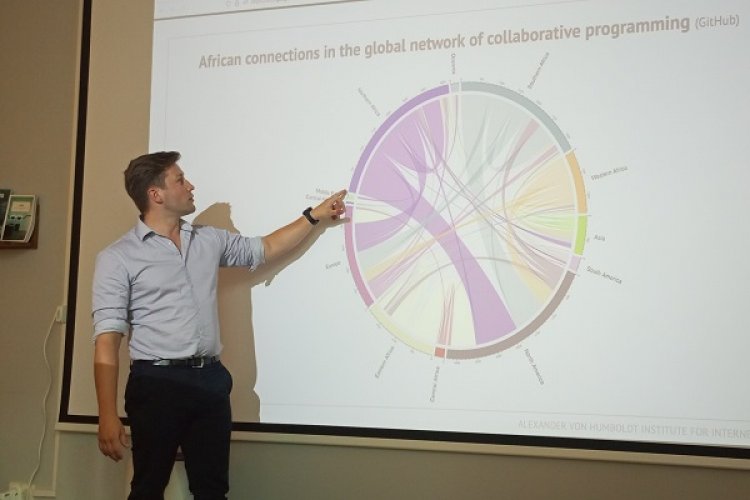

Official data suggest that mobile money has increasingly grown to become a multi-billion-dollar industry and Africa accounts for world’s largest mobile money transactions recorded

According to the global mobile phone operator lobby group GSMA, there are more money and transactions flowing through mobile wallets today than ever before, bringing a range of financial products into the hands of hundreds of millions of users and disrupting traditional financial services.

The lobby group indicated in its 2024 State of the Industry Report on Mobile Money that 1.75 billion registered accounts are processing $1.4 trillion a year, or about $2.7 million a minute.

Sub-Saharan Africa is home to almost three-quarters of the world’s accounts. Use cases are also evolving as mobile money users shift away from basic transactions to more varied services such as paying bills, school fees, paying for government services and the likes.

Leveraging this data could see lenders position many in the informal economy with growing income and expenditure patterns to have even bigger impact through access to financial products and services such as credit.

Without this shift, many who need credit the most are excluded. It has a bearing on the drive for financial inclusion.

Barriers

In Pieterse view, a number of challenges still stand in the way of inclusive credit economy: To be able to make a shift, financial institutions need analytical skills, mathematical skills and actuarial skills which in Africa are very scarce and come at a premium.

“And for them to go and invest and build a whole analytics team, with analytical capabilities will cost them quite a significant amount of money. And to make money out of this would take quite a number of years,” he said.

Another thing, he said, is that mobile money competes with banking. That’s why they (banks) have really not been paying attention to it.